Connect NETWORK MEMBERS

All Business:

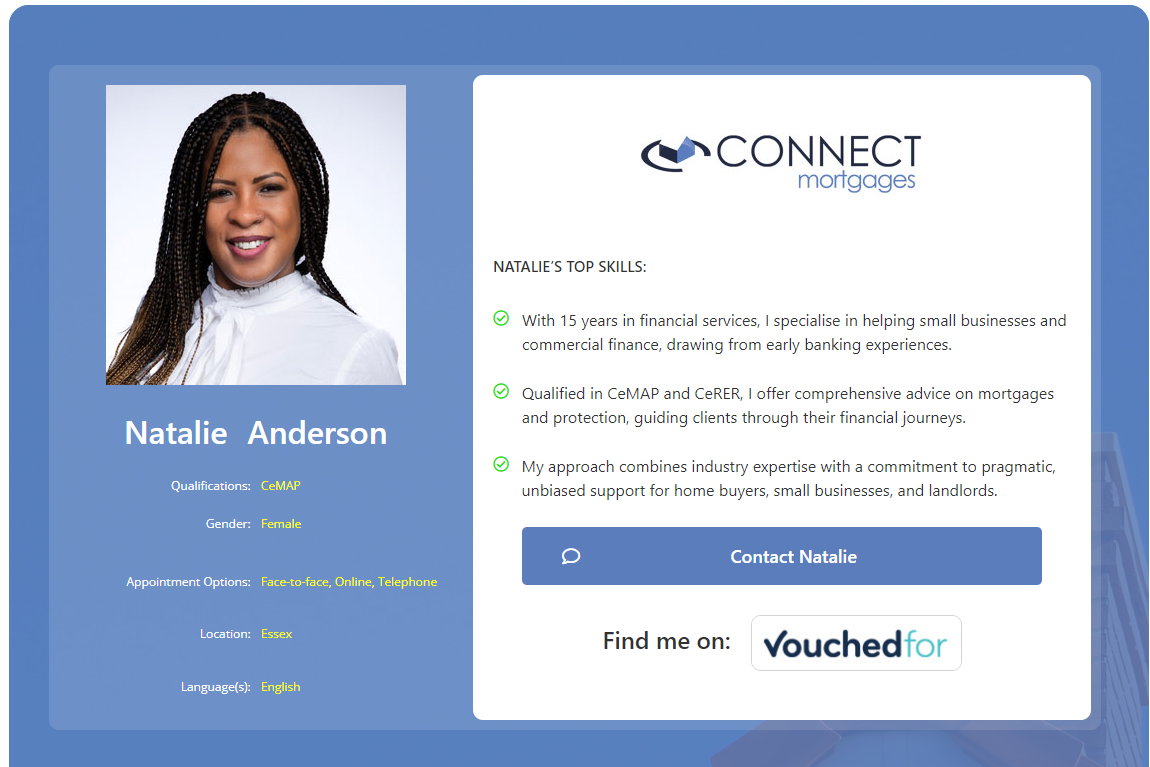

Connect Mortgages

For ALL your mortgage and protection needs.

MORE INFO | REGISTER

Case Management:

BOX Document Store

Connect's document storage facility: Access all your day-to-day advising tools like Fact Finds, Terms of Business documents and research materials through the BOX Document Store.

LOGIN | REGISTER

Sourcing:

Connect Mortgages Sourcing

Source the best mortgage rates to recommend to your clients with this system.

LOGIN | REGISTER

Legal & General Club

Visit the L&G Club Hub to access SmartrCriteria, SmartrSurvey and other L&G Club benefits.

LOGIN | REGISTER

Equity Release:

Connect Lifetime Mortgages

Join the thousands of people releasing equity from their own home! Looking to move home, buy for the first time, remortgage or release funds for retirement. Perhaps you are looking to invest in a buy to let property or need finance for commercial property or venture? We have helped people for over 20 years with finance to realise their property ambitions.

Secured Loans:

Fluent Money

Secured loans (also called homeowner loans) could be an option if you’re in a scenario where you want to borrow a large sum of money, perhaps to make home improvements or consolidating existing loans.

REGISTER

Fluent Money

We’re the UK’s largest specialist finance packager. Thanks to our whole of market offering for mortgage products and high level relationships with lenders, we’re able to meet customers’ needs with the most suitable product every time.

REGISTER

Development Finance:

Protection / Insurance:

Paymentshield

Obtain quotes from a panel of providers of buildings, contents and ASU products.

LOGIN | REGISTER

Protection Guru

Protection Guru gives you free access to detailed analysis on all the main protection products and services in the market.

LOGIN | REGISTER

The Source

Sourcing system for Buildings & Contents Insurance.

LOGIN | REGISTER

Stonebridge Protect

Stonebridge Protect works with mortgage advisers, lenders and other financial services professionals throughout the UK to ensure that their clients are fully protected by life insurance, critical illness cover, income protection and even private medical insurance. Talk to them too about commercial insurance.

If you would like us to chat about how we can help you,

please get in touch with Dale North Managing Director

dale@stonebridgeprotect.co.uk

✆ 0345 3197070

UnderwriteMe

The Protection Platform helps you sell multiple protection products from multiple insurers in one place, with a fully underwritten premium. The system underwrites as you complete your client's health details giving you confirmed pricing for a range of health issues. One-click submission for applications to multiple providers for multi-benefit plans.

LOGIN | REGISTER

Uninsure

The Protection Platform helps you sell multiple protection products from multiple insurers in one place, with a fully underwritten premium. The system underwrites as you complete your client's health details giving you confirmed pricing for a range of health issues. One-click submission for applications to multiple providers for multi-benefit plans.

LOGIN | REGISTER

Protect Commercial Insurance

We are a Commercial Insurance Broker specialising in commercial property, buy to let portfolio and small package insurance solutions with a unique distribution model receiving referrals from IFAs and mortgage brokers.

REGISTER

Conveyancing/ Surveying:

eConveyancer

eConveyancer works with a panel of +50 UK’s leading conveyancing firms who are quality assured and authorised and regulated by either the Solicitors Regulation Authority or the Council for Licensed Conveyancers.

.

LOGIN | REGISTER

SDL Surveying

SDL Surveying is a nationwide survey and valuation provider with over 30 years of expertise in the surveying field, delivering a range of private home surveys on behalf of our customers year-on-year.

Choosing to use our referral service allows SDL Surveying to offer tailored expert advice to your clients to ensure that they receive the right survey for their needs and are given confidence in their property purchase..

LOGIN | REGISTER

Sort Refer

Conveyancing is a necessary step when your customer is buying, selling or remortgaging. This is where SortRefer comes in. Let us get your client’s Conveyancing Sorted today.

REGISTER

CPD/ Education:

Connect Learning Management System

Increase your knowledge, get market updates and record your CPD via the Connect Learning Management System.

LOGIN | REGISTER

Register for a Service

As a Connect Network Member, you enjoy exclusive mortgage deals with competitive rates due to our strong lender relationships.

This inclusive strategy allows you to explore diverse options from various lenders, offering tailored choices for your financial needs. This flexibility sets Connect apart in the mortgage landscape. Not a member?

Connect has Access to a Semi-Exclusive Bridging Product

Bridge-to-Let Semi Exclusive

New Exclusive Product with Legal & General Mortgage Club

Semi-Exclusive Product with Legal & General Mortgage Club

Semi-Exclusive Product with Legal & General Mortgage Club.

Semi-Exclusive Product with Legal & General Mortgage Club.

Semi-Exclusive Product with Legal & General Mortgage Club.

Limited Edition Product Free Fee Exclusive

Vida Residential Exclusive

Vida Buy-to-Let Exclusive

Select an option..

MORTGAGE CALCULATOR

Calculate the monthly payments for a particular loan amount and interest rate using this repayment calculator.

RENTAL CALCULATOR

Calculate the amount you may borrow, the amount rent you may charge and the amount of coverage.

STAMP DUTY CALCULATORS

England

Stamp Duty:

Scotland

LBTT:

Wales

LTT:

Commercial

Stamp Duty:

These events are arranged by Connect and its associates, and arranged for the benefit of Connect Network Members and other Mortgage Intermediaries.

Browse through the following Connect organised, or key industry events.

EVENTS

WHEN:

–

EVENT TYPE:

DETAILS:

Zurich Accelerate | Session 1 - Fast Access and Comprehensive Support

WHEN:

–

EVENT TYPE:

DETAILS:

How does Vitality's Income Protection benefit your clients?

WHEN:

–

EVENT TYPE:

DETAILS:

Lunch & Learn" Session 2 - Valuable services and features

WHEN:

–

EVENT TYPE:

DETAILS:

Zurich Accelerate | Improving The Customer’s Medical Care Journey

WHEN:

–

EVENT TYPE:

DETAILS:

Navigating tomorrow | Understanding the Economy and Mortgage Market

WHEN:

–

EVENT TYPE:

DETAILS:

Zurich Accelerate | Application and underwriting process

WHEN:

–

EVENT TYPE:

DETAILS:

Mortgage Vision Event

WHEN:

–

EVENT TYPE:

DETAILS:

Zurich Accelerate | Pitching With Clients

WHEN:

–

EVENT TYPE:

DETAILS:

Mortgage Vision Event

LATEST CONNECT & INDUSTRY NEWS

Independent Financial Advisers | Why Join An IFA Network?

Many financial advisers ask this during their careers. Mortgage advice

Thinking of Leaving Your Mortgage Network? | Talk to Connect

Evaluate Your Reasons for Leaving Are you dissatisfied with the

Expert Mortgage Brokers | Find A Mortgage Adviser

Expert Mortgage Brokers Embarking on the journey to homeownership

Selecting the Right Network as an Appointed Representative

Whether you’ve just passed your CeMAP exam or are an

The Connect Network | Best Network (more than 300 ARs)

The Connect Network The Connect Network recently stood out

Join AR Network | Why Consider The Connect Network?

Join AR Network Connect Network is an award-winning platform created

Specialist Mortgage Packagers | Why DAs Should Use Them?

To understand the present and future, we must start with

Exploring New Horizons in Later Life Lending | The Challenge

The dynamics of later-life lending are evolving. Traditionally, equity-release products

Buy-to-Let and Holiday Let | An Insight for Advisers

The buy-to-let sector comprises properties in the private rented sector (PRS)

Find A Residential Mortgage Broker | Expert Mortgage Brokers

Are you considering buying your own home? Securing a residential

Regulatory Approval Options for Mortgage Firms

If you are a professional mortgage adviser, you must determine

Do I Need a Mortgage Adviser? | Expert Mortgage Brokers

Do I Need a Mortgage Adviser? Whether you’re a first-time

Advisers Should Talk Protection | Expert Mortgage Brokers

Financial advising crucially involves discussing protection plans like income protection,

The Value of Mortgage Advice | Expert Mortgage Brokers

The Value of Mortgage Advice When you start your

Buy-to-Let Watch Episode 11 | Expert Mortgage Brokers

Buy-to-Let Watch Episode 11 | The Rise of Expat and

How to Find a Mortgage Broker | Expert Mortgage Brokers

How to Find a Mortgage Broker Finding the right

Your Connect Mortgage Network | Network For Brokers

Your Connect Mortgage Network At Connect Mortgage Network, we’ve

Becoming an Appointed Representative | An AR With Connect

Becoming an Appointed Representative (AR) Becoming an appointed representative

Broker Vs Mortgage Lender | Knowledge is Power

Broker Vs Mortgage Lender It’s no secret that the

Connect Mortgage Network | Mortgage Network For Brokers

Connect Mortgage Network Embarking on a journey as a