How to Find a Mortgage Broker

Finding the right mortgage broker can significantly simplify buying a home’s financing process. A mortgage broker is an intermediary between you and potential lenders, helping you secure the best mortgage terms that align with your financial situation and housing goals.

Here’s a detailed guide on how to find a mortgage broker who can assist you effectively.

Understanding the Role of a Mortgage Broker

A mortgage broker is a professional authorised to offer mortgage advice and arrange mortgages with various lenders on your behalf.

Unlike direct lender representatives, who are confined to their own products, brokers can access a wide range of mortgages, providing you with tailored options to suit your specific financial circumstances.

Benefits of Using a Mortgage Broker

- Variety of Choices: Brokers have relationships with multiple lenders and can offer a broader array of mortgage products.

- Expert Advice: Brokers understand the nuances of different mortgage types and can recommend the best options based on your personal and financial situation.

- Time Efficiency: Brokers manage the paperwork and liaison with lenders, saving you valuable time.

- Cost Efficiency: Brokers often have access to deals that are more competitive than those you might find on your own, sometimes with exclusive rates.

How to Find the Right Mortgage Broker

- Ask for Recommendations: Ask friends, family, or your estate agent if they can recommend a broker. Personal endorsements are invaluable for finding someone both reliable and proficient.

- Verify Qualifications and Regulation: Ensure the broker is registered with the Financial Conduct Authority (FCA). This is mandatory for practising mortgage brokers in the UK.

- Research Online: Check online reviews and testimonials on platforms like Trustpilot or directly on Google. A broker’s online presence can also provide insight into professionalism and client service.

- Understand Their Fees: Brokers can be remunerated through fees you pay or commissions from the lender. Clarify their fee structure upfront to avoid any surprises.

- Enquire About Their Lender Network: The extent of a broker’s lender network can significantly influence the options available to you. Ask about the number of lenders they work with and any preferential lender relationships.

- Assess Their Availability: The mortgage process can be intensive; ensure your broker can guide you.

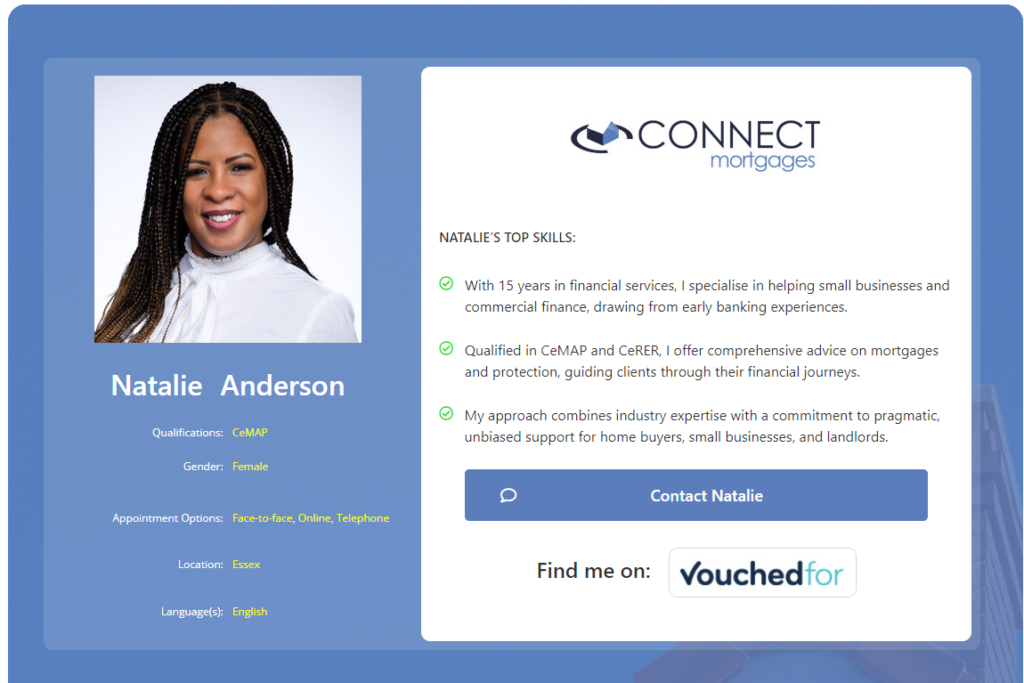

Using the Connect Mortgage Expert Directory

Connect has created a directory for potential mortgage seekers, enabling them to find an adviser based on more than just a general list. As a mortgage network, we aim to offer functionality that allows users to choose an adviser who matches their personal preferences.

This means users can select an adviser based on gender, expertise, location, or preferred communication style—face-to-face, online, or over the phone.

This personalised approach ensures that you can engage with confidence and receive advice in the way that feels most comfortable for you.

By clicking the link below, you can choose your type of mortgage. Then, you will complete a targeted set of criteria to help identify the adviser who best matches your preferences.